California Universal Health Care Workbook - 2018

Committee Chair:

Timothy D. Bilash MD MS FACOG

Committee Member Contributors:

Philomena Lin MSW LCSW

George Phillips EE

John Kaplan MD FACOG

Marilyn R Lyons MPP JD Financial Sevices Representative

February 09, 2018

The Chair gratefully acknowledges the valuable participation through discussion, comment and writings over the past year; all involved have made significant contributions in shaping the Workbook. It is the product of over 1000 hours of Volunteer effort. I also am humbly indebted during this time for the continued dedication, love and acceptance of my dear Roya whose patience made this report possible. She displays the highest ethics and caring, bringing unbounded joy to every endeavor. I am very fortunate.

Responsibility for the accuracy and contents of the Workbook rests entirely with the Chair.

- California Universal Health Care Workbook - 2018

TABLE OF CONTENTS

I. California Universal Health Care Workbook Introduction - February 09, 2018

II. Health Delivery Principles to Consider

III. Health Insurance History

IV. ACO - Accountable Care Organization

V. The Collaborative Model (Non-Physicians as Physician Substitutes)

VI. The Managed Competition-Enthoven-Electronic Technologies/EHR conundrum

VII. Tax Policy, Economic and Business Policy Issues

VIII. Quality

IX. Cost

X. California State Single Payer Total Health Insurance (SB-562/SP2.3)

XI. California Single Payer (CSP2.3) Intents

XII. California State Single Payer (CSP2.3) Benefits

XIII. Single Payer / Other Health Systems - Exploring the State Health Insurance Cafeteria

XIV. Review of State Business Gross Receipts Taxes - Proposed funding mechanism in CSP/2.3

XV. Medicare Program Essentials - Retired Worker Health Insurance Program (1965)

XVI. Media Objections to SB-562 - Researching the Sources

XVII. Legislative Objections

XVIII. Evidence "Biased" Medicine - The "Big Medicine" Whitewash?

XIX. Electronic Technology

XX. Excess Profits

XXI. The application of Flawed Economic Theory to Medicine. Can we understand History?

XXII. Recommended Resources

XXIII. Recent Legislative Testimony to the Select Committee CA Assembly on SB-562 (February 5x, 2017)

back

back

-

Medical Insurance in the United States has a complex history, especially its

financial complexity

.

-

"Health insurance in the United States is a recent phenomenon, less than eighty years old.

Prior to the 1930s, employers, unions, and religious and fraternal groups occasionally offered health care or benefits to their members, but modern health insurance did not exist. Health insurance in its contemporary form can be traced to the hospital prepayment plan offered by Baylor

Hospital to the white public school teachers in Dallas, Texas in 1932."

( 148-05 ) 148-05 Microsoft Word - Jost GYMR.doc - The_Regulation_of_Private_Health_Insurance. pdf <<< OPEN - First implemented as a Payroll Tax (Partially deductable thru Employer).

- Led to the alternative Private Insurance (Cash) Volunteer Dependency, with Local Hospitals that increased Services

- Now State programs are subsidized by the Federal Government (Hill Burton, then Medicare/Medicaid since the 1960's)

- Experiences in other Countries/States may not helpful for cost issues, as Automation and Loss of the Middle Class are inevitable

-

Tying Health Care to Employment Payroll is flawed

, as 300 Million need care but only 100 million are working

-

"Health insurance in the United States is a recent phenomenon, less than eighty years old.

Prior to the 1930s, employers, unions, and religious and fraternal groups occasionally offered health care or benefits to their members, but modern health insurance did not exist. Health insurance in its contemporary form can be traced to the hospital prepayment plan offered by Baylor

Hospital to the white public school teachers in Dallas, Texas in 1932."

- Providing Access to Care

is an ill-defined concept:

- Health Care is really a Need

(often argued a Right versus Entitlement). Meeting that Need is the goal.

-

10 commandments of Healthcare ?

( 135-01 ) Craig M. Wax, DO Medscape August 19, 2017

"The Knots in Healthcare"

1. Health insurance is not healthcare.

2. Health insurance is not health.

3. Health insurance is not a right.

4. Healthcare is not a right.

5. Healthcare is not health.

6. Health is not a right.

7. Individuals are smartest and healthiest when self-motivated to do so by natural consequences.

8. No individual should be obligated to work for free or be extorted by federal government force majeure to purchase items or services for others.

9. Government regulations and third-party reimbursement increases costs and decreases efficiency.

10. Direct patient pay for free market competing services is most efficient, cost effective and promotes excellence.

TAGS - Visit or Procedure or Treatment as Available Care (promised

)

is not the same as Obtained Care (received

)

or Costed

Care (paid for

)

. Administratively and Politically, we conflate multiple parts of these process and give credit only to the Insurance coverages, leading to documentable Cost Shifting

and more recently Care Shifting

(especially in Hospitals).

- Libertarian views espouse that you should buy Care with your own money. Those who don't "work for it" don't deserve care. For the wealthy this is not an issue. Individual, Governmental and Corporate Investment Activities in Securities are considered the equivalent of work, rather than distribution of the pie created by economic goods and services produced. These investments however are taxed at lower rates than payroll.

SO WHAT IS THE ROLE OF GOVENMENT FOR SOMETHING EVERY PERSON NEEDS, BUT IN DIFFERING AMOUNTS? Maybe we can separate out the direct pay from the market competition part for examination. Agreement about the Public Commons is the Basis of Civilization, with consent of the Governed.

- Health Care is really a Need

(often argued a Right versus Entitlement). Meeting that Need is the goal.

-

Insurance and Administration of Medicine is extremely wasteful in the US

(

Estimated 1/3

of Annual Spending

)

-

Administrative Costs

for Health Care has Increased 3000%

in the U.S. from 1970-2009

171-02 growth of administrators.pdf <<< EXPAND GRAPHIC

-

Kaiser Family Foundation/Bureau of Labor Statistics

https:// me.me /i/3500-growth-of-physicians-and-administrators-1970-2009-3000-2500-2300-11964044

-

Kaiser Family Foundation/Bureau of Labor Statistics

-

Wasted Dollars

in US Health Care, 1/3 of $3 Trillion Dollars

, is well documented (2009). (

IOM

& Pollin

Analyses)

( 171-02 ) 171-02 IOM Report/ Estimated $750B Wasted Annually In Health Care System | Kaiser Health News.pdf

171-0 http://resources.nationalacademies.org/widgets/ vsrt / healthcare-waste.html ? keepThis =true& <<< VIDEO

-

171-01a excess health costs slide.pdf

<<< EXPAND GRAPHIC

-

171-01a excess health costs slide.pdf

<<< EXPAND GRAPHIC

-

Administrative Costs

for Health Care has Increased 3000%

in the U.S. from 1970-2009

-

Hospital Care increases Health Costs - the conundrum

. Hospitals are the most expensive place to give Medical Care. The US has continued to expand Hospital facilities, closing down smaller offices and moving them into larger consolidated Hospital-based facilities. They have taken on huge building programs and expansion of Hospital facilities

that now face budget shortfalls

. This has fueled an explosion in Administrative cost. It is the advanced stages of "

Vulture Capitalism

".

- Hospitals have always lost money on operations, requiring subsidy.

- The Hospitalist

/Collaborative Model introduces even more overhead

than prior systems.

- Hospitals have always lost money on operations, requiring subsidy.

-

US has astronomical Drug and Procedure Prices

.

-

US has fewer Physicians Per Capita

-

The US has fewer Physicians to care for patients than other countries.

177-07 Feb13_ Michener.pdf

177-07 per capita lower.pdf <<< EXPAND GRAPHIC

- 178-01 MDpercapitaGraphuc.pdf

<<< EXPAND GRAPHIC

-

The US has fewer Physicians to care for patients than other countries.

- Consumer attitude of Entitlement

is encouraged, without regard to resources accepting the broken system.

-

What needs are entitled, and Who deserves them? (dividing the pie, vs privileging from membership in a class; encourages tribalism)

- High School, College Education

- Food, Clothing, Shelter

- Medical Care

-

Cable Entertainment

-

THERE IS NO FREE LUNCH!

-

What needs are entitled, and Who deserves them? (dividing the pie, vs privileging from membership in a class; encourages tribalism)

back

back

- Insurance in the U.S.

- "Unlike other countries,

insurance regulation is conducted at the state level rather than at the national level in the U.S.

This has been the case since its inception and was reaffirmed by the Congress when it enacted the McCarran-Ferguson

Act (

MFA

) in 1945. The MFA

delegated the principal responsibility for regulating insurance to the states except in instances where the Congress chooses to intervene and establish federal authority over certain areas of insurance or firms involved in the business of insurance." (

148-01

) <<< OPEN

https://papers.ssrn.com/sol3/ papers.cfm ?abstract_id=2026898

- "At the Federal level, there are a number of important statutes applicable to health care insurance. The McCarran-Ferguson

Act provides that even though the insuring or provision of health care may be national in scope the regulation of insurance is left to the states. Likewise, the Health Maintenance Organization (HMO) Act

provides that HMO's or health service plans are regulated by the states....

in California health insurers are regulated by the Department of Insurance and HMO's and health service plans are regulated by the Department of Corporations

." (

148-08

) <<< OPEN

https://law.freeadvice.com/insurance_law/health_insurance/health_insurance_ regulation.htm

- "At its core,

the insurance relationship is based on a contract

under which the insured pays money to an insurance company at one point of time with the understanding that if certain losses described in the contract eventuate at a later point in time, the insurer will cover the loss. The insurer pools risk, collecting premiums from many insureds, only a few of whom will recover their full premium, at least in the short run (and many insureds have only a short-term relationship with health insurers.) The insurer, however, is at risk of paying out large sums of money for the benefit of a few of its insureds in the short run, and for the benefit of many more in the long run if the relationship persists. This relationship is inherently problematic.

" (

148-05

)

148-05 Microsoft Word - Jost GYMR.doc - The_Regulation_of_Private_Health_ Insurance.pdf <<< OPEN

- "First, its viability depends on the financial capacity of the insurer to respond to the claims of its insureds, the total of which can potentially exceed the sum total of premiums received."

- "Second, the insured depends on the insurer’s good faith and efficient business practices for the prompt and fair payment of claims. In the short run at least, it may be in the financial interest of the insurer to delay payment of claims and to dispute claims that are in any way questionable, or even to refuse to pay legitimate claims."

- "Third, an insurance contract is typically a long and complex instrument, drafted by the insurer . Few terms, if any, are negotiated. It is what is known in the law as an adhesion contract. The insured is largely dependent on the insurer for assuring that this contract meets the reasonable expectations of the insured as to the coverage that is being purchased and that it does not contain terms that can be used unfairly to deny coverage when risks eventuate. The insured is largely dependent on the insurer for assuring that this contract meets the reasonable expectations of the insured as to the coverage that is being purchased and that it does not contain terms that can be used unfairly to deny coverage when risks eventuate."

- "Finally, the insured is largely dependent on the marketing practices of the insurer to understand the nature of the insurance product that is being purchased and to avoid unreasonable expectations as to the extent of coverage."

- "

The insurance transaction is further complicated by the problems of adverse selection and moral hazard

.... An insured driver may drive less carefully, a person with health insurance may smoke more or exercise less.... The classic example of moral hazard is the insured ship owner scuttling a ship to collect on the insurance policy."

- "A number of arguments support giving the states more power to reform health insurance. The states are closer to, and thus more responsive to, the needs of their citizens

; states are freer to experiment

and thus to identify more varied and better solutions to problems than the monolithic federal government; states are better able to address regional variations in health care needs and preferences. Allowing states to take different approaches also allows persons or businesses with preferences for more or less health care coverage or expenditures a range of options. On the other hand, s

ignificant arguments can be made for health care reform at the federal leve

l

."

( 148-05 ) 148-05 Microsoft Word - Jost GYMR.doc - The_Regulation_of_Private_Health_ Insurance.pdf <<< OPEN

- The fundamental higher cost for private insurance

is obvious. "

Health insurance companies must make money to stay viable

. To make money, the insurance company sets premium rates according to risk. If the insurance company covers mostly healthy people, there is good chance money will be left over at the end of the day... [many] insurance regulators come from a previous life of being (drum roll here) – insurance industry executives... Or they work in regulation and may move to jobs in (another drum roll) – the insurance industry.

https://www.forbes.com/sites/ carolynmcclanahan /2012/06/19/should-states-really-regulate-health-insurance/#1f6c3b88b8bd ( 148-02 ) <<< OPEN

- "

Workers who buy individual health insurance policies

, in sharp contrast to workers enrolled in employer-based group insurance, do not enjoy the generous tax breaks that accompany the purchase of employer group plans

. Because non-group markets are a market of last resort for so many individuals, the cost of premiums in these markets likely affects whether or not many of these Americans can afford to purchase health insurance for themselves and their families."

http://www.healthinsuranceindepth.com/ individual-state-guides.html ( 148-07 ) <<< OPEN

- The State of Texas Website describes Health Insurance decisions facing patients, particularly for Plan Comparisons.

( 148-09 ) http://www.tdi.texas.gov/pubs/consumer/cb005.html#rates

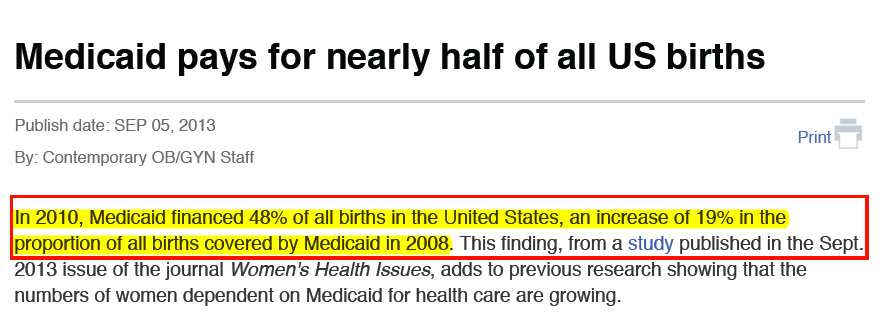

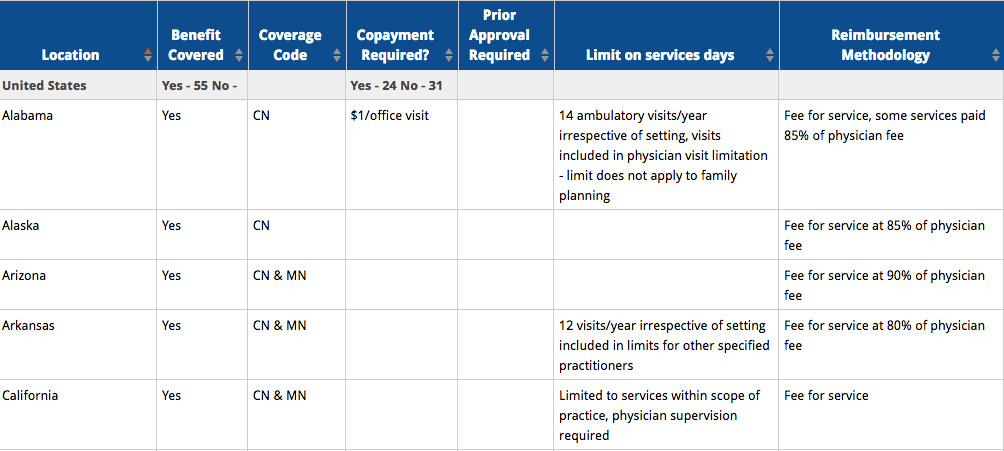

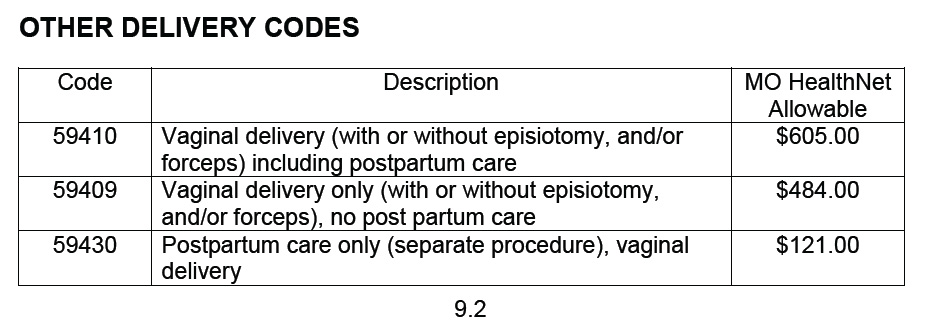

- Medicaid pays for nearly half of all US births.

(152-01) 152-01 Medicaid pays Contemporary OBGYN.pdf

- It is useful to remember that In-Office services were not covered by insurance until more recently

. Blue Cross/ Blue Shield Hospitalization policies were introduced, but they only covered a limited number of out-patient follow-up appointments. Office Care charges were paid as a commercial transaction (cash, on-time, or written off).

- "Unlike other countries,

insurance regulation is conducted at the state level rather than at the national level in the U.S.

This has been the case since its inception and was reaffirmed by the Congress when it enacted the McCarran-Ferguson

Act (

MFA

) in 1945. The MFA

delegated the principal responsibility for regulating insurance to the states except in instances where the Congress chooses to intervene and establish federal authority over certain areas of insurance or firms involved in the business of insurance." (

148-01

) <<< OPEN

- Insurance Regulation

- State Regulation of Health Insurance

- "In California, health insurance is regulated by the California Department of Insurance

(

CDI

)."

https://www.insurance.ca.gov/01-consumers/110-health/10-basics/ health-ins-reg.cfm ( 148-03 ) <<< OPEN- Reviews every policy for sale in California to make sure that it follows the law

- Offers consumer support about your policies, file a complaint, or contest a decision by your insurers;

- Investigates fraud and takes enforcement action when necessary

- Reviews insurance companies' finances to make sure that they are stable

- Licenses brokers and agents who sell insurance in California

- "In California, health insurance is regulated by the California Department of Insurance

(

CDI

)."

- Proposals to regulate Health Insurance at the Federal Level instead of the State Level (2005)

- "The Small Business Health Fairness Act of 2005 (

H.R

. 525), the Health Care Choice Act of 2005 (

H.R

. 2355), and H

ealth Insurance Marketplace Modernization and Affordability Act of 2005

(S. 1955) [had it been] enacted

would fundamentally change the way health insurance is regulated in the United States

. In this context, the future of health insurance regulation is not entirely clear." "The three bills intend[ed] to make markets more competitive by making it easier for insurance companies and associations to operate – not having to do business within the constraints of 51 different sets of regulators and rules.

( 148-12 ) https://www-tc.pbs.org/now/politics/ Healthinsurancereportfinalkofmanpollitz . pdf <<<OPEN

- An unintended consequence, however, may be to allow new ways to segregate health insurance markets by risk. Consequently, to the extent that current insurance regulations have reached a balance in promoting competition while ensuring an equitable spreading of risk – through rating, covered benefits, and other rules that protect access to coverage by healthy and sick alike – the segmented market could destabilize premiums and coverage.

Ironically, this may lead to a reduction in protection from medical expenses that health insurance offers individuals, families, and employers. It may lead to no private health insurance options for consumers with medical needs and fewer choices for others. It remains to be seen what direction for health insurance regulation the Congress may set, and what changes in private coverage may result."

"Congressional sponsors appear to depart from traditional reliance on states as laboratories for innovation and as primary regulators of health insurance. In the past, federal legislation established a floor of national standards. The three proposals would do the opposite . Also, while in the past Congress heavily relied on states to implement federal standards, the bills pending in Congress would substantially restrict state ability to regulate health insurance.

"All three bills would also have the effect of reducing the overall level of health insurance regulation by any level of government. While they would restrict authority of states to regulate risk selection, to limit unfair market practices, and to engage in oversight, none of the proposals would invest substantial new regulatory authority or capacity with the federal government. In this respect, the three bills could be viewed as de-regulating health insurance to varying degrees."

( 148-12 ) https://www-tc.pbs.org/now/politics/ Healthinsurancereportfinalkofmanpollitz . pdf <<< OPEN

- "Other federal laws also affect insurance coverage. Congress has adopted three coverage mandates, requiring insurance plans to provide forty-eight hours of hospitalization for a normal delivery and ninety-six hours for a Cesarean section, to pay for breast reconstruction if they cover mastectomies, and, subject to a number of exceptions, to not apply annual and life-time limits to mental health coverage that are less generous than those applied to physical health coverage.

The Age Discrimination in Employment Act requires employers in general to offer the same coverage or coverage of the same value to their employees regardless of age, while the Pregnancy Discrimination Act requires employee benefit programs to cover pregnancy and childbirth related services. The Americans with Disabilities Act (ADA) prohibits at least intentional discrimination against the disabled in insurance underwriting, although as a practical matter it permits insurers to take health status into account as long as they do so rationally."

https://www.nasi.org/ usr _doc/The_Regulation_of_Private_Health_Insurance . pdf ( 148-05 ) <<< OPEN

- "in the end, our experience with insurance and managed care reform would seem to teach us that it is very difficult to make private, for-profit, insurers behave as anything other than private for-profit insurers. The surest route to profit for an insurer is to attract the lowest risk applicants available at any given premium.

There is always more money to be made by an insurer by managing risk exposure than by trying to manage health care costs. Beyond this, insurers that intend to remain in the market try to provide as generous benefit packages as the market demands and to maintain a reputation for good service, at least to low-cost insureds.

Regulatory efforts may budge insurers slightly from these business strategies, but rarely much or for long. This is particularly true in the current environment, in which any insurer, employer, or individual can simply cease to sell or buy insurance if it does not like the opportunities or options available at any given moment in any given market. " ( 148-05 ) <<< OPEN

- "Of course, insurance can be made more affordable by allowing it to cover less. “

Barebones

,” high cost-sharing policies sold in the individual market to young, healthy individuals can be quite inexpensive. But these policies also leave those who purchase them exposed to considerable financial risk, as well as to the possibility of not being able to afford health care when it is needed

. A number of studies have been published in recent years examining the plight of “underinsured” Americans. Nearly one in six American families spent more than ten percent or more of their income (five percent or more if low income) on out-of-pocket medical costs in 2001–02

.

These families were more than twice as likely not to obtain needed medical care and half again as likely to delay or have difficulty finding needed care as insured Americans generally. Another study found that adults with health problems with deductibles above $500 (and particularly those with incomes below $35,000 a year) are much more likely than those with lower deductibles not to fill a prescription, not to get needed specialist care, to skip a recommended test or follow-up visit, or to have a medical problem for which they have not sought medical care.

Patients with high deductibles are also much more likely to have problems with medical bills or medical debt. Nearly half of “underinsured” adults were contacted by a collection agency about medical bills in the year before a recent survey, while more than one-third said that they had to change their lives significantly to pay for medical bills.... Nevertheless, many American households would be stretched were they required to bear the full cost of health insurance premiums out of pocket ."

https://www.nasi.org/ usr _doc/The_Regulation_of_Private_Health_Insurance . pdf ( 148-05 ) <<< OPEN

- "It should be noted that insurance costs in the individual market can have a large impact on the number of uninsured individuals. The individual market is effectively a residual market, consisting largely of those without access to employer-sponsored insurance

. Workers who buy individual health insurance policies, in sharp contrast to workers enrolled in employer-based group insurance, do not enjoy the generous tax breaks that accompany the purchase of employer group plans.

Because non-group markets are a market of last resort for so many individuals, the cost of premiums in these markets likely affects whether or not many of these Americans can afford to purchase health insurance for themselves and their families.... Furthermore, emerging economic trends will likely increase the share of the working population without access to employer-sponsored insurance."

Heritage Foundation Health Insurance Regulations State-by-State 2005

http://www.healthinsuranceindepth.com/ individual-state-guides.html ( 148-06 ) <<< OPEN

- "The Small Business Health Fairness Act of 2005 (

H.R

. 525), the Health Care Choice Act of 2005 (

H.R

. 2355), and H

ealth Insurance Marketplace Modernization and Affordability Act of 2005

(S. 1955) [had it been] enacted

would fundamentally change the way health insurance is regulated in the United States

. In this context, the future of health insurance regulation is not entirely clear." "The three bills intend[ed] to make markets more competitive by making it easier for insurance companies and associations to operate – not having to do business within the constraints of 51 different sets of regulators and rules.

- "Could the fact that

insurance regulators are significantly intertwined with the insurance industry explain the lack of protection for consumers in many states? Texas is a great example... many state insurance regulators come from a previous life of being (drum roll here) – insurance industry executives. Or they work in regulation and may move to jobs in (another drum roll) – the insurance industry. This also happens on the federal level." It looks like the Professional Physicians and Nurses have been shunned.

https://www.forbes.com/sites/ carolynmcclanahan /2012/06/19/should-states-really-regulate-health-insurance/#1f6c3b88b8bd ( 148-02 ) <<< OPEN

back

- State Regulation of Health Insurance

back

- "Developed nearly a decade ago to help rein in the growth of Medicare spending and improve patient outcomes, ACOs

now are gaining attention as a way for independent practices to lessen their reporting burden under Medicare’s new payment system while possibly increasing their revenue." (2017)

( 40-03 ) 40-03 Top risks and rewards of ACOs . pdf <<< OPEN

- "Depending on the type of ACO , membership could carry financial risk . It may also mean practices must adopt new information technology , as well as giving up some autonomy."

- "a major goal of the 2015 Medicare payment reform law was to move the program away from fee-for-service in favor of value-based reimbursement systems."

- “ We’re seeing a big ramp-up in [practice] consolidation , whether it’s through an ACO or something else, because [ MIPS ] is a heavy financial and workflow lift, and to get the necessary support as an independent provider is pretty tough ,” says Steffany Whiting, strategy and marketing officer with CHESS, a firm that provides management services to ACOs .

-

ACO's

offer Centralized Corporate Control, with vertical and horizontal integration, allowing a merger of tax and tax-exempt processes

.

- Why Accountable Care Organizations Are Like Vegan

Barbeque.

( 40-05 ) 40-05 Why accountable care organizations are like vegan barbecue . pdf <<< OPEN

The ACO system has been evolving in hopes of cost containment. Despite the advantage of expanded access to Primary Care, No pre-existing exclusions or Maximum Limits, there are consequences.

-

1 Jeff Goldsmith .

pdf

<<< Intro

- 2 ACO's

Hosp

marginalize doctors .

pdf

<<< Prediction on Costs

-

3 US halved specialist pay .

pdf

<<< Decreased Physician Reimbursement

-

4 judgement pay too low .

pdf

<<< Medical Judgement Excluded from Reimbursement

-

1 Jeff Goldsmith .

pdf

<<< Intro

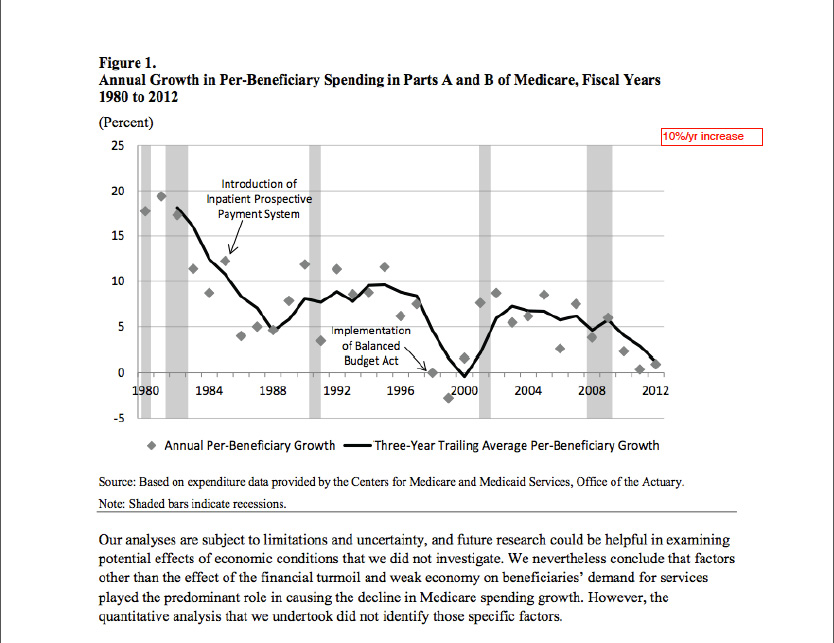

- "CMS

has now conducted three demonstrations of the 'accountable care organization,' and all of them have failed

...The taxpayer has now financed three ACO

demonstrations – the PGP

, Pioneer, and MSSP

demos. (6/2017)

( 40-02 ) 40-02 Would ACOs Work If They Were Turned Into HMOs? THCB <<< OPEN

- Pioneer ACO

program

, which ran from 2012 through 2016, cut Medicare spending by three- or four-tenths of a percent on average over its first four years.

-

Physician Group Practice (

PGP

)

Demonstration, which ran from 2005 to 2010, raised Medicare costs by 1.2 percent.

-

Medicare Shared Savings Program (

MSSP

)

, which began in 2012 and may lumber on indefinitely, has raised Medicare costs by two-tenths of a percent on average over its first four years.

- "It is way past time for CMS

and health policy researchers to determine why all three ACO

demos failed

."

( 40-02 ) 40-02 Would ACOs Work If They Were Turned Into HMOs? THCB <<< OPEN

-

ACO

(and private insurance) in-Network requirements are a form of Partial-HMO. "M

any Medicare recipients in FFS

Medicare are there because they don’t want to enroll in a Medicare Advantage plan, and they’re hoping Medicare beneficiaries will be too dumb to notice that they’re being offered a bribe to enroll in an HMO dressed up as an ACO

... Once you comprehend how confused the doctors are, you’ll shake your head and wonder how anyone could think patients will ever understand the flabby ACO

concept.

- Although ACO

proponents claimed ACOs

would be “run by doctors” and would therefore be kinder and gentler than HMOs, it turns out doctors not only didn’t run the Pioneer ACOs

, they had a poor understanding of what their ACOs

were doing to and for them. According to L&M’s final evaluation of the Pioneer program, “The vast majority of providers participating in Pioneer ACOs

were not directly part of the decision to participate, but rather were employed by or part of a medical group that joined the ACO

... The one feature of ACOs

the great majority of doctors understood clearly was that ACOs

impose more paperwork on doctors. “Approximately three-quarters of Pioneer physicians indicated that participation had required them to increase time spent on administrative, documentation, and reporting tasks…”

- “Representatives from many of the Pioneer ACOs

noted that

it was more difficult than initially anticipated to manage beneficiary utilization and patient visits outside of the ACO

."

-

ACO

managed care methods, "

guarantees high churn rates among doctors and patients

, shunts sicker patients away from the ACOs

, and assigns few ACO

patients to each ACO

doctor...

Evidence-free decisions

led to CMS’s

plurality-of-visits method

."

-

ACO

(and private insurance) in-Network requirements are a form of Partial-HMO. "M

any Medicare recipients in FFS

Medicare are there because they don’t want to enroll in a Medicare Advantage plan, and they’re hoping Medicare beneficiaries will be too dumb to notice that they’re being offered a bribe to enroll in an HMO dressed up as an ACO

... Once you comprehend how confused the doctors are, you’ll shake your head and wonder how anyone could think patients will ever understand the flabby ACO

concept.

- "It is possible that some of the managed care tools ACOs

are expected to use... (would at least improve quality and might lower costs as well) if they were applied to subsets of the chronically ill

." "

It’s clear those tools are never going to work if they are applied to entire 'populations.'

Managed care proponents must stop thinking in terms of structures (

ACOs

, HMOs, 'integrated systems,' 'medical homes') that apply managed care magic to entire populations, and start thinking in terms of specific services delivered to subsets of the chronically ill

."

-

Could we move to the Specialist as the primary care provider for these ill individuals rather than gate-keepers?

-

Could we move to the Specialist as the primary care provider for these ill individuals rather than gate-keepers?

- Measuring ACO

performance

-

(40-06) 40-06 ncqa

_

aco

_measures_fact_sheet_0 .

pdf

<<< OPEN

-

"

NCQA

now has the performance measures that Accountable Care Organizations (

ACO

) need to deliver better quality care at lower costs

. ACOs

coordinate doctors, hospitals and other health professionals to make sure people get all the care they need, while fighting waste and overuse. This requires collecting, integrating and using data to provide high quality, well-coordinated, patient-centered care and identify where ACOs

can improve quality and efficiency

."

-

"

NCQA

now has the performance measures that Accountable Care Organizations (

ACO

) need to deliver better quality care at lower costs

. ACOs

coordinate doctors, hospitals and other health professionals to make sure people get all the care they need, while fighting waste and overuse. This requires collecting, integrating and using data to provide high quality, well-coordinated, patient-centered care and identify where ACOs

can improve quality and efficiency

."

-

(40-06) 40-06 ncqa

_

aco

_measures_fact_sheet_0 .

pdf

<<< OPEN

- Pioneer ACO

program

, which ran from 2012 through 2016, cut Medicare spending by three- or four-tenths of a percent on average over its first four years.

- "New Generation" ACO

- adding more downside risk to offset increased cost?

( 40-04a ) 40-04a ACOs Plan to Move to Downside Financial Risk, Capitation Contracts . pdf (2017) <<< OPEN

- History of next generation ACO

Types -

There has been a constant flux in care models even since ACO's have been introduced, each change initiated when the last failed to meet its promise. The NeXt Gen ACO Model is "similar to the Pioneer Model but with higher potential rewards and risk than MSSP Tracks. Next Gen aims to transition providers from fee-for-service to capitation."

( 40-03 ) 40-03a ACO Types Compared . pdf <<< EXPAND

-

"

ACOs

anticipate entering downside financial risk contracts within the 10 months for shared savings/losses arrangements and 17 months for capitation, a survey showed." "Organizations across payers are also bearing similar financial risk levels. About 53 percent of ACOs

said that their organization has the same financial risk levels in their commercial and Medicaid contracts as their Medicare arrangements."

- "Only 28 percent of physician-led ACOs

have an active risk-based contract, whereas almost one-half (48 percent) of hospital-led ACOs

are assuming downside financial risk."

-

"

With ACOs

spending a significant portion of their budgets on health IT and care management, organization leaders are finding cost reductions to be a major challenge

.

"

- "Most ACOs

offer services for primary care (94 percent), labs and imaging (77 percent), specialty care (74 percent), and inpatient care (71 percent). Only

7 percent offer dental care

, 39 percent have long-term care

, and 49 percent manage pharmacy services

." Note that SB-562(CSP2.3) is wet to cover Dental, Long-term Care, and negotiate Pharmacy over-costs down.

-

Southern California had long relied on the Administrative contributions by the Independent Physician Practices, and is late to the transformation into Managed Care Models. Not much public attention is being paid to these problems. History repeats itself, with a twist.

(Please see

40-02

40-02 Would ACOs

Work if They Were Turned into HMOs? | THCB.pdf

)

-

Patient Centered Care

- decentralize the centralization under a coalesced corporate control

- Organizations are bought up, the administrative financial control retained, remainder allowed to atrophy.

- Caregivers deliver patient-centered care in an open environment that provides access to systematic analysis of all available evidence in electronic format from an extensive, ever-changing, continually updating, reliable statistical set. (011896)

-

Mimics arbitrage activity of financial merger and sell-off, as if the mission of the organization is organizing.

- History of next generation ACO

Types -

-

Downside Risk

(I keep the profit, You take the loss)

- One of the differences between now and the Hospital Financial Crash in the late 1990's is who was liable for the losses

. At that time Hospital Systems had moved into Capitation/Managed Care Models, and had bought up Private Practices in an effort to further the desired consolidation. Attending Physicians sold their practices to the Hospital Systems, and continued on as Employees. The worked in the same office as before. They used the same Staff as before. The saw the same patients as before. They were just owned on paper by the Hospital.

- Only problem was, Hospitals went broke

doing this. They had to be bailed out of the financial mess. In particular, the Federal Government took on a huge debt (still not paid off) to infuse cash into the Hospitals. They sold off the Practices, and bought out the Doctors' contracts. The Big Managed Care retreated, and many things went back towards the former systems. The Hospitals lost. The Doctors mostly retired early with a great nest egg and moved down to Florida.

- In the current setting, Physicians and Employees particularly take on "downside risk"

and are responsible as investors in the ACO

Corporations. As the crisis in other Industries, pension funds and retirement health funding become at risk as assets of the Corporation. Health Care Corporations are again facing huge loses and layoffs across the country to fill the financial gap: Banner Health Corporation laid off hundreds of workers nationwide including Physicians.

-

Medicaid has a habit of auditing an agency many years later - a Case in point is the San Diego Hospice, which had to declare bankruptcy and were sold off to Scripps Hospital. The well reported audit indicated they had been paid some tens of millions of dollars too much. Whether or not there were merits to the actions, the issue becomes who pays back the money. New, essentially deferred debt suddenly becomes due, having exaggerated benefit in the previous years.

San Diego Hospice could have been saved - San Diego news from inewsource

San Diego Hospice: The end of a journey

- The ACO

system as part of the Affordable Care Act (

ACA

) is problematic in this regard, because there is increased Risk assumed by this approach and increased Administrative Overhead to mine any savings.

-

Scripps Health (San Diego)

fired their CEO and are dealing with a

$30 Million dollar budget gap this year

.

- 2015 - Scripps dedicates $500 Million to EPIC computer system.

(40-11) 40-11 Physician 40-11 News Stories September 2015. pdf <<< OPEN

-

2017 -

"Scripps nixes hospital CEO positions and $30M in services"

( 40-12 ) 40-12 Scripps nixes hospital CEO positions and $30M in services _ Healthcare Dive . pdf <<< OPEN

"Scripps Health is cutting hospital C-suite positions and slashing $30 million from corporate services in an effort to remain viable in today’s changing healthcare environment, Modern Healthcare reported."

- 2015 - Scripps dedicates $500 Million to EPIC computer system.

-

The Sharp Health System (San Diego)

abandoned the Pioneer Managed Care program.

-

2012

- Sharp's Pioneering ACO

May Raise Bar in San Diego

(

40-08

)

- "One thing at least some of the organizations are excited about is that eventually CMS would be willing to go to a capitated approach. I think a lot of these Pioneer ACOs , given that they are leaders in care coordination already, like that option," said John Pickering, principal consulting actuary with the actuarial and consulting firm Milliman ."

- "Pioneer ACOs are likely to find their infrastructure somewhat lacking, particularly as they take on functions historically performed by health plans.... Some of the things that they're going to need in place in order to be successful are utilization management functions, such as disease management, complex case management, preauthorization services, specialty referral management, and other analytic tools. In particular, financial and actuarial modeling, which has typically been performed at the health plan level, will be an important contributor to the success of these organizations"

- "Perhaps the biggest challenge Pioneer ACOs

will face is that beneficiaries have the freedom to visit any health care provider accepting Medicare and not stay within their assigned ACO

network."

-

2014

-

"Sharp HealthCare

ACO

drops out of Medicare's Pioneer program"

( 40-10 ) Sharp HealthCare ACO drops out of Medicare's Pioneer program - Modern Healthcare . pdf <<< OPEN

- "Another Medicare Pioneer accountable care organization has exited the program, renewing questions about its long-term sustainability. Sharp HealthCare

, a five-hospital system in San Diego, said... that it dropped out of the Pioneer ACO

program."

- "Another Medicare Pioneer accountable care organization has exited the program, renewing questions about its long-term sustainability. Sharp HealthCare

, a five-hospital system in San Diego, said... that it dropped out of the Pioneer ACO

program."

-

2012

- Sharp's Pioneering ACO

May Raise Bar in San Diego

(

40-08

)

-

Scripps Health (San Diego)

fired their CEO and are dealing with a

$30 Million dollar budget gap this year

.

- One can think of the money problem using an analogy. When investing in Certificate of Deposit or Savings Bond, there is a guaranteed payout amount. The principle can not be lost. The purchase of stock has a downside risk - potentially the entire value of the stock can be lost. This is what ACO's

are moving into. An additional type of risk is the equivalent of buying on margin, when you potentially owe more than than was invested; Hospital Administration as Stock Option Trading. This is where we are.

- One of the differences between now and the Hospital Financial Crash in the late 1990's is who was liable for the losses

. At that time Hospital Systems had moved into Capitation/Managed Care Models, and had bought up Private Practices in an effort to further the desired consolidation. Attending Physicians sold their practices to the Hospital Systems, and continued on as Employees. The worked in the same office as before. They used the same Staff as before. The saw the same patients as before. They were just owned on paper by the Hospital.

- Comparing ACO

(Accountable Care Organizations) to FFS

(Fee-For-Service) Performance

-

A comparison of

fee-for-service to ACO's

indicates cost saving in some cases

. However, when results are scrutinized in one of the reports as an example, FFS

patients were 2 years older in the first years, and mortality was actually 6% better in the FFS

group than ACO

in the later years, skewing results.

( 40-18 ) ACOvsFFS joi150049 . pdf <<< OPEN

ACO vs FFS . pdf <<< EXPAND

-

A comparison of

fee-for-service to ACO's

indicates cost saving in some cases

. However, when results are scrutinized in one of the reports as an example, FFS

patients were 2 years older in the first years, and mortality was actually 6% better in the FFS

group than ACO

in the later years, skewing results.

-

Accountable Care Organizations in California

https://bcht.berkeley.edu/sites/default/files/ accountable-care-orgs-in-ca . pdf ( 158-0 ) <<< OPEN

-

Aggregation of Medical Groups across Regions has been unsuccessful.

Rapid Expansion through Mergers and Acquisitions can increase market stability, but Economies of Scale have not materialized

.

1Healthcare is local, 1990's . pdf <<< EXPAND

-

ACO

Utilization Cost Advantage has diminished.

3ACO less cost advantage . pdf <<< EXPAND

-

Capitation requires Non-Uniform Payment Mechanisms.

2Capitation, farm subsidies, malpractice burden . pdf <<< EXPAND

-

Size: Economies and Diseconomies of Scale

4More admin, no economies of scale . pdf <<< EXPAND

-

HMOs require Regulation which Increases Cost

5HMO failure . pdf <<< EXPAND

-

ACOs

are not a Panacea for Health Care Spending Control

7short term evaluations . pdf <<< EXPAND

-

Aggregation of Medical Groups across Regions has been unsuccessful.

Rapid Expansion through Mergers and Acquisitions can increase market stability, but Economies of Scale have not materialized

.

- Delivery Care Complexity and the Development of ACOs

.

1-

InTheBeginning

.

pdf

<<< EXPAND

-

In the Beginning Patients needed care, and paid when they could.

-

Then Hospitals were needed.

2-

ThenHospitals

.

pdf

<<< EXPAND

-

Hospitals were increasingly expensive.

3-

HelpWithTheBills

.

pdf

<<< EXPAND

-

Keep the Costs down with Administrative oversight.

4-

ManagedCare

.

pdf

<<< EXPAND

-

Cover the uninsured retirees.

5-Medicare .

pdf

<<< EXPAND

- Creation of ACO's

.

6-

ACOs

.

pdf

<<< EXPAND

- The Future? ACO's

using Certificated Providers.

7-

ACOsplusCertified

.

pdf

<<< EXPAND

-

Structural Issue Complexity in the Affordable Care Act (Scripps Summit 2016)

Hope and Reality - There is No Administrative Visibility of Physicians and Nurses

ACO Chart (no md or pts ) . pdf <<< EXPAND

-

In the Beginning Patients needed care, and paid when they could.

back

back

- The Rise and Falls of Physician Trained Authority

- Medicine in the American Colonial Period

- During the colonial and early federal periods (the height of "heroic medicine"), purgings

, bleedings, and high doses of toxic drugs constituted treatment for almost every condition. The public developed a very skeptical attitude towards regular doctors. Bands of "Sects" freely gave medical advice, emphasizing the participation of the patient in his or her own treatment.

- Perhaps over-promising and use of marginal treatments has awakened a tremendous mistrust of Medicine once again and the trust in Internet "do-it-yourself" medicine. It makes us more vulnerable to fads and "quack medicine", which at one time had even been legal in London. Slowly, scientific understanding replaces these practices but it has become difficult to bridge the knowledge-gap.

( 106-01 ) Bankrupt Hospitals in England Turn to Private Sector | Managed Care magazine

- During the colonial and early federal periods (the height of "heroic medicine"), purgings

, bleedings, and high doses of toxic drugs constituted treatment for almost every condition. The public developed a very skeptical attitude towards regular doctors. Bands of "Sects" freely gave medical advice, emphasizing the participation of the patient in his or her own treatment.

- Increasing surveillance of Physicians in Current Times

- A requirement took effect in January 2008, requiring hospitals to establish a “Focused Professional Practice Evaluation” for physicians, such as a sentinel event, a near-miss, complaints from staff or patients, or not meeting benchmarks during the ongoing evaluation process. We have entered another period of distrust.

141-01 ACOG Today, January 2008 - acogToday0108 . pdf ( 141.01 )

- There are few provisions for evaluating CEO and Administrative Staff malfeasance, except through the Hospital System Boards (

ie

, shareholders). CEO's convicted of child abuse and sexual abuse (which can include worker abuse) have gone undetected for years in too many cases.

- A requirement took effect in January 2008, requiring hospitals to establish a “Focused Professional Practice Evaluation” for physicians, such as a sentinel event, a near-miss, complaints from staff or patients, or not meeting benchmarks during the ongoing evaluation process. We have entered another period of distrust.

- Medicine in the American Colonial Period

- The "Collaborative Model" in Medicine promotes the Non-Physician as a Clinician, Administrator and Executive

. It has evolved from the original role functioning as "Physician Extender"; to actually replacing Physicians both in Primary Care and Specialties. It has been continuously supported by Medical Organizations like the American Medical Association (AMA) and the American College of Obstetricians and Gynecologists (

ACOG

).

- Evolution of the Model

- The "Collaborative Model" is based on an Academic Theoretical framework, pursued for over 50 years by the Institute of Medicine (

IOM

).

- It deconstructs patient care into smaller more similar tasks requiring less training, much as car repair in a body shop would operate. People get categorized as to their common, interchangeable illnesses that make factory care more efficient. However, the expectations require performance beyond their training level, seen as "efficient".

- Who is Primary Care - Provider Class Ambiguity

- MA, PA-C, NP, RN, MD, Specialist, Sub-Specialis , CRNA , CCA , CHPE ... titles are examples. (145-01)

- Medicine versus Nursing vs Technical vs Clerical

- Practitioner Title Inflation and the loss of the Medical Middle Class

- Swap Titles of Nobility for Professional Accomplishment

- Swap Titles of Nobility for Professional Accomplishment

- The "Collaborative Model" is based on an Academic Theoretical framework, pursued for over 50 years by the Institute of Medicine (

IOM

).

- Diagramming the Collaborative Model

( 144-02 ) 144-02 collaborativemodelgraph.pdf

- Administrative View of the Collaborative Model

175-02a Triple Aim Scripps Quality Summit Syllabus 2013. pdf

- Where are the Doctors and Nurses?

- Where are the Doctors and Nurses?

- How Nurse Practitioners Obtained Provider Status

(40-20) How Nurse Practitioners Obtained Provider Status pdf <<< OPEN

- Brief Timeline of the Collaborative Model in Maternity Care (The ACOG-ACNM

Project)

(133-0) 133-0 Essential Components of Successful Collaborative Maternity Care Models . pdf <<< OPEN

- [1971]

High-quality maternity care could be provided by teams

of Physicians, Nurse-midwives, Obstetric nurses, and others. These teams would be directed by a "qualified Obstetrician-Gynecologist"

[

ACOG

Joint Statement on Maternity Care]

- [1972]

Academic health centers should educate health professions students together

, and other educational institutions should affiliate with interdisciplinary education programs [

IOM

Report] ("Committee Medicine")

- [1975]

"Obstetrician team direction" no longer means being physically

present [

ACOG

Supplemental Statement Guidelines]

- Responsibility for team care is accepted by the obstetrician-gynecologist. Compensation shifts from performance of activity to increased liability, and eventually to inadequate compensation.

- Arrangements for formal consultation with an obstetrician-gynecologist required, if team leadership is provided by a physician not trained in obstetrics and gynecology.

- A written agreement

is needed to clarify consultation and referral policies (may involve financial arrangements).

- [2001]

Removed the language for direction of the Maternity team by an Obstetrician

. Instead required inclusion of an Obstetrician with hospital privileges "on the team" to guarantee complete care

. [

ACOG

Revised Joint Statement]

- [2001]

Identified the need to redesign the way health professionals are trained

[

IOM

].

- [2010]

Nurses should be full partners

, with physicians and other health care professionals, to redesign health care in the United States [

IOM

]. The term reengineering was used in the 1990's for a similar process that flattened professional distinctions.

- [2011]

Collaborative Practice Review by American College of Obstetricians and Gynecologists and American College of Nurse Midwives.

- A general, an inductive approach

to qualitative content analysis

was urged based on statistical outcomes

and regimentation (Nurse approach).

- Note that the elimination of deductive methods implies the elimination of Science. Inductive methods may be utilized in Science, but sole reliance on them leads to well characterized statistical errors (for instance, using a confirmatory test for screening. Individual differences become subservient to global protocols.

- Physicians however are required to abide by randomized controlled trials and committee opinions offered by the Academic and Certfied Community.

- Most practices studies were based in urban areas and were part of larger teaching hospitals , limiting general validity.

- Practices utilize advanced practice nurse specialists

and sub-specialty physicians

from areas such as Neonatology, Perinatology

, Reproductive Endocrinology, Maternal-Fetal Medicine, Urogynecology

, and Gynecologic Oncology to enforce Opinions and Protocols.

- A general, an inductive approach

to qualitative content analysis

was urged based on statistical outcomes

and regimentation (Nurse approach).

- [1971]

High-quality maternity care could be provided by teams

of Physicians, Nurse-midwives, Obstetric nurses, and others. These teams would be directed by a "qualified Obstetrician-Gynecologist"

[

ACOG

Joint Statement on Maternity Care]

- Concerns about outcomes

under the Collaborative Model?

- US Perinatal

Mortality is worsening

(2% increase in California 2016)

- US Maternal deaths have increased

(doubled in California) with the initiation of the Collaborative Model

- "American women are more than three times as likely as Canadian women to die in the maternal period.

...in the U.S., maternal deaths increased from 2000 to 2014. Nearly 60 percent of such deaths are deemed preventable.

...In every other wealthy country, and many less affluent ones, maternal mortality rates have been falling "- 5/12/2017 What's Behind America's Maternal Death Rate

(182-03) 182-03 What's Behind America's Maternal Death Rate_ _ NPR.pdf

- 5/12/2017 What's Behind America's Maternal Death Rate

- "American women are more than three times as likely as Canadian women to die in the maternal period.

- Managed Care and Mid-Level Model has

failed to control costs

- "Employing nurse practitioners to provide first-line care in UK general practice is likely to cost the same or slightly more than employing doctors ."

- Costs are pushed off to the future , deflected or ignored. The emphasis is on Investment Profit.

- The Hospitalist

/

Laborist

Model is also

more costly

($200,000 per hospitalist

per year).

- Cost-effectiveness of Collaborative Telemedicine

for Depressive Disorders is uncertain

.

- Patients with disability for PTSD

(Post Traumatic Stress Discorder

) were randomly assigned to Telemedicine

Outreach for PTSD

(TOP)

or usual care. Only minor improvements in Quality of Well--?Being (

QWB

) and

quality-adjusted life years (

QALYs

) were found. The TOP intervention was relatively expensive

,

with costs totaling $2,029 per patient per year. Intervention costs were not offset by reductions in health care utilization costs, resulting in an incremental cost-effectiveness ratio of $185,565 per QALY

(

interquartile

range $57,675 to $395,743).

- ...There remains considerable uncertainty due to inconsistent results among included studies. Reviewed cost-effectiveness analyses differed considerably in terms of economic quality, and risk of bias remained uncertain in the majority of studies, due to insufficient reporting ...studies should be conducted in large and representative patient samples from a societal perspective, taking into account indirect costs."

- May 19, 2015 Cost-Effectiveness of Collaborative Care for the Treatment of Depressive Disorders in Primary Care: A Systematic Review (9-0)

- July 7, 2017 Cost-Effectiveness of Telemedicine-Based Collaborative Care for Posttraumatic Stress Disorder. ( 7-0 )

- Costs of Telemedicine-Based

Collaborative Care for Posttraumatic Stress Disorder were not offset by reductions in utilization costs

. In fact, no demonstrated cost savings are evident (

British Journal of General Practice July 2006)

- Patients with disability for PTSD

(Post Traumatic Stress Discorder

) were randomly assigned to Telemedicine

Outreach for PTSD

(TOP)

or usual care. Only minor improvements in Quality of Well--?Being (

QWB

) and

quality-adjusted life years (

QALYs

) were found. The TOP intervention was relatively expensive

,

with costs totaling $2,029 per patient per year. Intervention costs were not offset by reductions in health care utilization costs, resulting in an incremental cost-effectiveness ratio of $185,565 per QALY

(

interquartile

range $57,675 to $395,743).

- Study biases are apparent

and there is varying accounting for indirect costs. Assumes for example than Certified Nurse Midwives (

CNM

) are "known to be cost-effective providers with documented success". Comparisons need to be done based on equal-dollar funding

for system as well as outcome measures.

- Medical Care by Assistants and Nurses is arguably a Third World Model, compensating for limited Physician workforce.

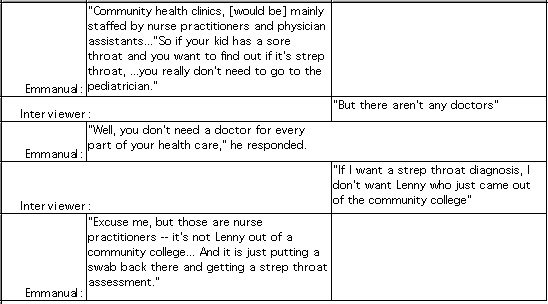

- Ezekiel Emmanuel MD

has been one of the major National Proponents of the Collaborative Model

- Emmanuel originally proposed "universal health care could be guaranteed by replacing employer paid health care insurance, Medicaid, and Medicare with [government] health care vouchers

funded by a value-added tax." This is a regressive Tax, leaving individuals to negotiate charges for themself

. It is a free market approach championed in Economics by Milton Friedman.

- "You're going to free up doctors of paperwork

and a lot of stuff that could be done by other people

to focus on really important cases and the complex ones that don't fit right in the box... Physician assistants and registered nurses will play a greater role in treating routine illnesses, giving doctors more time to focus on "really important cases,.. We're going to shift what doctors do to the high end, where they are really valuable."

- Shifts the reward from what a person does to what "cost-effective" profit they generate ("hi-end")

- Shifts the reward from what a person does to what "cost-effective" profit they generate ("hi-end")

- Ezekial

Emmanuel expresses his view of the "physican extender" as a "physician replacer".

(4-0) Ezekiel Emanuel Reinventing American Health Care (2014)

Interview:

- Zeke

Emmanuel, Healthcare, Guaranteed

- (2-01) Pepperdine

Conference Video - March 23, 2017

Future of Health Care Symposium, Dr. Ezekiel Emanuel Remarks- "The Collaborative Model is a total failure."

- "The Collaborative Model is a total failure."

- Emmanuel originally proposed "universal health care could be guaranteed by replacing employer paid health care insurance, Medicaid, and Medicare with [government] health care vouchers

funded by a value-added tax." This is a regressive Tax, leaving individuals to negotiate charges for themself

. It is a free market approach championed in Economics by Milton Friedman.

- US Perinatal

Mortality is worsening

(2% increase in California 2016)

- Evolution of the Model

- "Purging" of the Medical Middle Class

- Non-Physician vs Physician Medical Care

(40-01) Are Nurse Practitioners Practicing Medicine

- In North Carolina, an NP (Nurse practitioner) is defined as a currently licensed registered nurse approved to perform medical acts

consistent with the nurse's area of NP academic

educational preparation and national certification

under an agreement with a licensed physician for ongoing supervision, consultation, collaboration, and evaluation of medical acts performed. This replaces the traditional view that doctors and nurses are trained and certified to practice in clinical programs.

- A removal of Clinical training in programs, replaced with Certificated Authority.

- In North Carolina, an NP (Nurse practitioner) is defined as a currently licensed registered nurse approved to perform medical acts

consistent with the nurse's area of NP academic

educational preparation and national certification

under an agreement with a licensed physician for ongoing supervision, consultation, collaboration, and evaluation of medical acts performed. This replaces the traditional view that doctors and nurses are trained and certified to practice in clinical programs.

- Degree Creep

- adding additional layers of certifications for higher paid, while lower paid levels have lower requirements.

- Academic Creep

- "Rising by degrees" is the term. Management titles, more required "diplomas" lead to higher salaries for physicians, survey shows, Michael Romano

( 143-01 ) December 2003, Modern healthcare 33(46):16.

143-01 rising by degree.pdf <<< OPEN

- "Like almost everyone else in the nation's increasingly sophisticated workforce, doctors who have the longest string of degrees or titles after their name tend to earn the highest salaries. And the more letters the better... Physicians in top management positions who have a master's degree in business administration in addition to their medical school diploma earn almost 35% higher salaries..."

- As well, Cejka

Search President Carol Westfall

indicates, "the key to success in healthcare-along with riches-continues to be day-to-day, hands-on experience as a manager.

- "Like almost everyone else in the nation's increasingly sophisticated workforce, doctors who have the longest string of degrees or titles after their name tend to earn the highest salaries. And the more letters the better... Physicians in top management positions who have a master's degree in business administration in addition to their medical school diploma earn almost 35% higher salaries..."

- "Rising by degrees" is the term. Management titles, more required "diplomas" lead to higher salaries for physicians, survey shows, Michael Romano

- Certification Creep

- A model study advocating providing MAs

for NPs

indicated that this would make NP utilization cost effective, implying that using NP's alone currently is not

cost effective. On the basis of the model parameters we use, the average cost of serving a patient can be reduced by ~10% if MAs

are hired to support NP

s

. It is a name that tunes approach.

- As well, their model assumed that MA's could be shared

. In practice this is not realistic because of issues of chaperoning, room turnover and patient education. Also, MA's are certificated workers, not academically or clinically trained in the traditional sense and can only provide very superficial interactions with patients. These models assume no RN involvement in care. Theoretical Models are commonly used to justify staffing decisions in Nursing, but apparently Physician medical judgements informed by Academics and Theory are not allowed in clinical care decisions.

- A model study advocating providing MAs

for NPs

indicated that this would make NP utilization cost effective, implying that using NP's alone currently is not

cost effective. On the basis of the model parameters we use, the average cost of serving a patient can be reduced by ~10% if MAs

are hired to support NP

s

. It is a name that tunes approach.

- Academic Creep

- Administrative excesses at Academic Centers

- Administrative problems at the University of California System is an example of widespread corruption problems:

- The Los Angeles Times wrote, "

UC

is far too inclined to use public money as a slush fund... UC

administrators have a disquieting tendency to run a loose ship, and run it by their own, rather than state or university rules. "improving the statistics became the mission of the program... UCI

Medical Center CEO Dr Ralph Cygan

"provided false information to keep the unit running."

- "

UC

leaders were recompensed, with as little public notification as possible; and about just how badly UCI

was mismanaged, despite the excellent compensation of its leaders..."

- "the UC cases suggest that lavish executive pay and perks at health care organizations, rather than being necessary to attract good leaders, actually correlates with bad leadership. Perhaps executives who are most concerned about their personal financial advancement are less likely to be devoted to the academic and health care mission."

- “University of California administration is paying excessive salaries and mishandling funds, state audit.... The audit of the UC

Office of the President appears to have uncovered the same kind of budgetary misrepresentations and executive excess that we’ve seen before with the State Parks Department and the Public Utilities Commission,” Rendon

said in a statement.

- More Trouble in the OC

: Golden Parachutes for UC

Leaders, and "Malfeasance" at UCI

,

( 143-02 ) 143-02 Health Care Renewal_ Search results for malfeasance at UCI . pdf 2005 <<<OPEN

- The Los Angeles Times wrote, "

UC

is far too inclined to use public money as a slush fund... UC

administrators have a disquieting tendency to run a loose ship, and run it by their own, rather than state or university rules. "improving the statistics became the mission of the program... UCI

Medical Center CEO Dr Ralph Cygan

"provided false information to keep the unit running."

- Administrative problems at the University of California System is an example of widespread corruption problems:

- Non-Physician vs Physician Medical Care

back

back

- Origins of Managed Competition

-

Alain Enthoven

, protege of Robert McNamara

(Ford Motor Company)

- Understanding driving forces behind this scheme and how it has left Medicine in rubble;

"Managed Competition" in Autos, War, Education and Medicine (has not worked).

- "

The phrase 'managed competition'

actually came from [Robert] McNamara

, who used the concept while he was president of Ford Motor Company to force the various divisions of the automaker to streamline corporate workings. Shapley

says that McNamara

later used the same phrase to describe his strategy of playing off the armed services against each other. Enthoven

, however, dismisses this etymology as "fanciful" and "preposterous," and maintains that he came up with the term for his health-care system himself, in 1986."

- Rand Corporation Theoretical Models

guided the effort (after 1955 - as it became governmentally declassified)

- Hired PhD's from Academia and ROTC Lieutenants in areas judged worthy disciplines

- Looked at the "Larger Picture" at the expense of the local details (?"Academic Strategy")

- Henry Linn, Albert Woftedder , Harry Rowan, Fred Hoffman, Les Aspen PhD (Oxford, MIT )

- Robert McNamara (Manage from the Grand Totals Down, not Details Up).

- This approach creates a view that is invisible to those not in the top echelon, and ignores their inputs ("Ruling Elite").

- Pentagon Defense

utilization program sources

- Grouped Weapons systems by their Budgets and tied those Budgets to Goals

- Academic Strategy and Prediction approach - Tactics replaces Strategy

- Charlie Hitch (1959 Nuclear strategy, weapons systems analysis team concept)

- Joe Peck, David Steager

, Vick

Heyman

- Alain Enthoven

is an important figure in theoretical models for centralized control systems. His hour long interview from 2010 provides a framework for understanding how we got here and what is fueling it. "Conversations of History" (136-01)

- Understanding driving forces behind this scheme and how it has left Medicine in rubble;

- Managed Competition Principles

- Fundamentally

Managed Competition

is based on Academic Theory

- It relies on Theory and Computer Modeling - but seldom is testable

- Augments Credibility by providing Theoretical Gravitas

, giving power to dominate decision making with little ability to challenge (Academic Degrees)

- May encourage

decisions that are rationalized or made by "Wishful Thinking."

It requires a constructed ignorance of the local conditions.

- Managed Competition in Health Care - Use of Non-Physicians

( 22-01 ) 22-01a putting non-physicians in charge. pdf <<< EXPAND

- Fundamentally

Managed Competition

is based on Academic Theory

- Health Care Highlights to Note

- Changes in the U.S. Health Care have

required enormous increases in Administrative Overhead Costs

.

- "Reluctance to consider other options seriously over time may stem partly from the support that the Clinton campaign received from the managed care sector of the private insurance industry, as well as from a

perception that simpler and more popular options, including a single-payer approach, are unlikely to pass in the U.S. Congress

."

- "The only

countries that have successfully contained costs are those using single-payer financing

.

"

- "Rats and roaches live by competition under the law of supply and demand; it is the privilege of human beings to live under the laws of justice and mercy. It is impossible not to notice how little the proponents of the ideal of competition have to say about honesty, which is the fundamental economic virtue, and how very little they have to say about community, compassion, and mutual help

."

- CBS 60 Minutes has recently reported on [drug and equipment supplier] McKesson's complicity in the Opioid

Crisis

. Enthoven

spent four years as a director and stockholder of PCS, Inc., a "pharmaceutical managed care" company that was taken over by the drug distribution giant McKesson Corporation in 1989. "In its 1993 annual report, McKesson noted, 'With PCS, [we are] in a prime position to benefit from the rapid growth of managed-care health plans.'

( 23-01 ) 23-01 1MotherJones MJ93/ The godfather of managed competition | Mother Jones.pdf

- Changes in the U.S. Health Care have

required enormous increases in Administrative Overhead Costs

.

- Origins of Managed Competition

-

Alain Enthoven

, protege of Robert McNamara

(Ford Motor Company)

********* \/ If you read anything, READ THIS***************** !!!!!

23-01 EnthovenSumm1HL.pdf <<<OPEN (Review Article - 29 pages)

References for Article:- "

Is Managed Competition the Answer

" - Mother Jones - 1993

https://www.motherjones.com/politics/1993/05/motherjones-mj93-godfather-managed-competition/ - "

Computers, Electronic Data and the Vietnam War

" - Donald Fisher Harrison

- 1994

https://archivaria.ca/ index.php / archivaria /article/view/11490/12434 - "

Alain Enthoven

: An Outspoken Champion for the Prepaid Group Practice

" - 2004

https://www.ncbi.nlm.nih.gov/ pmc /articles/PMC4690696/ - "

The Strange Career of Managed Competition: From Military Failure to Medical Success?"

- 1994

http://connection.ebscohost.com/c/articles/9406150705/ strange-career-managed-competition-from-military-failure-medical-success - "

Alain Enthoven

states that single payer may be inevitiable

" - 2003

http://www.pnhp.org/news/2003/ september / alain-enthoven-states-that-single-payer-may-be-inevitiable

- "

Is Managed Competition the Answer

" - Mother Jones - 1993

- Bill Clinton Task Force 1993

/"Hillary Care"

- The Forward to the Clinton Presidential Task Force Report is telling regarding a Single Payer Plan.

1993 Presidential Task Force Foreword (download pdf): 1993 Health Care Reform.pdf <<< OPEN

- "a single-payer system might achieve the goals of health care reform as well as - or better than - the form of managed competition with a budget that has emerged from the Presidential Task Force. However, a single-payer system imposed by the federal government may not be politically feasible... In fact, it may never have been feasible given the deeply entrenched American patterns that tie health care to employment and the insurance industry

."

- "a single-payer system might achieve the goals of health care reform as well as - or better than - the form of managed competition with a budget that has emerged from the Presidential Task Force. However, a single-payer system imposed by the federal government may not be politically feasible... In fact, it may never have been feasible given the deeply entrenched American patterns that tie health care to employment and the insurance industry

."

- Bill Clinton empaneled a Task Force to craft Health Reform. Contrary to common belief, "by the time Hillary [Clinton] became involved in health-care reform in late January 1993, Bill Clinton's thinking about the problem was already well advanced. He had settled on the basic model for reform -- "a plan for universal coverage based on consumer choice among competing private health plans, operating under a cap on total spending", an approach known as "managed competition within a budget".

- The decision meetings about the plan took place outside the formal structure of the task force, usually in the Roosevelt Room of the White House, and the president ran the meetings himself.

- The President's Task Force -- consisting of members of the cabinet and several other senior officials -- proved to be useless for reaching decisions and drafting the plan. It immediately became the subject of litigation and dissolved at the end of May without making any recommendations.

- Ira Magaziner

is best known for leading, along with Hillary Clinton, the failed Task Force to Reform Health Care in the early Clinton administration. Brad DeLong

, Deputy Treasury Secretary for the Clinton administration at the time, argues that Magaziner's

failures stemmed from having a background in management consulting instead of policy." Magaziner

was court ordered to pay $285,864 to the Association of American Physicians and Surgeons, in 1997 by a federal judge for lying about whether the Task Force to Reform Health Care hired non-governmental employees and therefore had to release documents from their strategic deliberations upon public request. The fine was later overturned on appeal on August 25, 1999.

- The concept of 'health decided by wealth' - can not work when the government bears responsibility for the costs, because of an inherent inability to predict who requires more resources before-hand. Tying care to employment and to insurance is a death blow.

- Paul Starr

has written extensively and an often sited resource on Health Care Reform. Here is an article written on his perspective of the Health Reforem

in the Bill Clinton Administration:s

( 146-01 ) The Hillarycare Mythology HL.pdf <<<OPEN

- The Forward to the Clinton Presidential Task Force Report is telling regarding a Single Payer Plan.

- There is a need additionally to Examine the Concept of The "Free" Market and its Corporate Interpretations

- Milton Freedman

championed flawed economic theory (Neo-Liberalism, the Free Market would rule all).

- Business is more efficient than Government in running services for the people

- Centralized Governmental Limitations on Individuals

- Collapse of Brazil, Venezuelan Economies under Gross Free Market Policy

- Allows lawless Corporate dominance (used to be termed Laissez-Faire)

- Milton Freedman

championed flawed economic theory (Neo-Liberalism, the Free Market would rule all).

back

back

-

Taxes paid by Industry Sector

Ranking America’s industries by profitability and tax rate